The decisions you make when claiming your Social Security retirement benefit could make a big difference to survivor benefits that might be available to your spouse. That's why it is important to consider these benefits long before they are needed.

Survivor benefits for a spouse are based on the retirement benefit that the deceased worker was collecting or entitled to collect at the time of death. If the worker claimed benefits at full retirement age, or died before claiming benefits and before reaching full retirement age, survivor benefits would be based on the full retirement benefit amount, called the Primary Insurance Amount or PIA.

If the worker claimed a reduced benefit before reaching full retirement age, survivor benefits for a spouse would be based on the amount the worker would be receiving if still alive, but not less than 82.5% of the worker's PIA. On the other hand, if the worker delayed claiming benefits after full retirement age, survivor benefits would be based on a higher amount, including delayed retirement credits of 8% per year (up to age 70).

Spouse's Benefit Amount

The benefit that a surviving spouse can receive is based on the age when he or she claims the survivor benefit. A spouse must have been married to the deceased for nine months or more, with some exceptions.

- Full retirement age (65 to 67, depending on birth year) — 100% of the deceased worker's benefit

- Age 60 up to full retirement age — 71½% to 99% of the worker's benefit

- Disabled spouse, age 50-59 (disability starting before or within seven years of the deceased worker's death) — 71½% of the worker's benefit

- Spouse of any age caring for the worker's child under age 16 or disabled and eligible for child's benefits — 75% of the worker's benefit

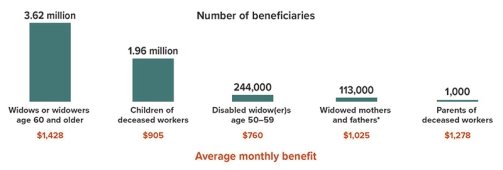

Who Receives Benefits?Almost 6 million Americans receive Social Security survivor benefits. As shown in the chart below, most of them are surviving spouses age 60 and older and children of deceased workers.

*Benefit is based on caring for a child under 16 or disabled.Source: Social Security Administration, April 2020

The following situations apply to spouses who are eligible for more than one type of Social Security benefit. Generally, an individual is always eligible for the highest benefit amount for which he or she qualifies.

- A spousal benefit (retirement benefit based on the deceased spouse's work record) will automatically convert to a survivor benefit after the Social Security Administration receives the report of death; a survivor benefit is always higher than a spousal benefit.

- A spouse can switch from a survivor benefit to his or her own worker benefit as early as age 62; however, it could be more beneficial to continue receiving the survivor benefit and allow the spouse's worker benefit to grow.

- A spouse not yet receiving retirement benefits can apply for a retirement or survivor benefit and switch to the other benefit, if higher, at a later date.

- A spouse already receiving retirement benefits can apply for a survivor benefit only if it would be higher than the current retirement benefit.

A surviving spouse who remarries before age 60 (age 50 if disabled) is not eligible to receive survivor benefits based on the deceased spouse's work record while married. Remarriage after age 60 does not effect eligibility for survivor benefits.

Divorced Spouse

A divorced spouse can receive the same benefits as a current spouse if the marriage lasted for 10 years or more. A divorced spouse caring for the deceased's child who is under age 16 or disabled may be entitled to benefits regardless of age or the length of the marriage.

Minor or Disabled Child

An unmarried dependent child under age 18 (age 19 if attending elementary or secondary school full-time) is eligible for survivor benefits equal to 75% of the late parent's PIA. A disabled child whose disability began before age 22 is eligible regardless of age. Stepchildren, adopted children, and grandchildren may also be eligible for benefits.

Dependent Parents

A parent who is a least age 62 and has been receiving at least half of his or her support from the deceased worker may be eligible for survivor benefits equal to 82½% of the worker's PIA for one parent or 75% for each of two parents.

Family Maximum

The amount that all surviving family members may receive is generally limited to 150% to 180% of the deceased worker's PIA. If the sum of payable benefits exceeds this limit, all benefits will be reduced proportionately. Benefits paid to a divorced spouse generally do not count toward the family maximum; however, benefits paid based on caring for a minor or disabled child do count against the maximum. Note that survivor benefits can be reduced when the beneficiary works before reaching full retirement age and earns more than an annual maximum.1

Check your Social Security Statement at ssa.gov/myaccount for an estimate of future benefits that might be available to your family. For more information on survivor benefits, visit ssa.gov/benefits/survivors.