Workers with pensions can sometimes choose to take their benefit as a lump sum instead of a monthly payment when they retire. In addition, some companies are taking steps to eliminate or reduce the size of their pension plans, along with the associated costs and liabilities, in order to limit the impact of future retirement obligations on their current financial performance. This may involve offering lump sums to vested current or former employees.

For many workers, there are clear mathematical and psychological advantages to keeping a pension, but for others, the lump sum could provide much-needed financial flexibility.

The prospect of a large check might be tempting, but cashing out a pension could have costly repercussions for your retirement. It's important to have a long-term perspective and consider the following factors when a sizable lump-sum offer is on the table.

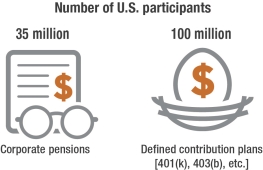

Relying on Retirement PlansEven though 401(k)s are now the most common type of employer-sponsored retirement plan, many Americans are still covered by PBGC-insured pension plans either as active, vested and separated, or retired participants.

Sources: Pension Benefit Guaranty Corporation, 2019; American Benefits Council, 2019

Terms of the offer. The amount of a lump sum is based on the discounted present value of an employee's future pension, set by an IRS formula based on current bond interest rates and average life expectancies. Keep in mind that a pension's lifetime income may be more valuable for women than for men because women tend to live longer, but gender is not considered when calculating lump sums. In addition, companies may not include the value of subsidies for early retirement or spousal benefits in their buyout offers, the latter of which could be a major disadvantage for married couples.

Taxes and potential penalties. Pension payments (monthly or lump sum) are taxed in the year in which they are received. Cashing out a pension before age 59½ may trigger a 10% federal tax penalty, unless the lump sum is rolled into an IRA, which postpones taxes until withdrawals are taken later in retirement.

IRA distributions are also taxed as ordinary income, and withdrawals taken prior to age 59½ are subject to the 10% federal income tax penalty, with certain exceptions. Annual minimum distributions are required starting at age 72 (or 70½ if this age has been reached prior to 2020).*

Financial resources. A lump sum might be helpful for someone with little cash in the bank for emergencies or with debts to pay off. Those who are able to live comfortably on other sources of retirement income might also benefit from a lump sum.

Risk tolerance. A lump-sum payout transfers the risks from the pension plan sponsor to the participant. Individuals who opt for a lump sum must then manage that money and determine for themselves how much risk to take in the financial markets. Often the amount is not enough to replace the pension income given up, unless the investor can tolerate exposure to stock market risk and is able to achieve decent returns over time.

Health status. A lump-sum payment might make sense for a participant with potentially life-threatening medical issues, because pension payments end when the plan participant (or a surviving spouse) dies. Money held in an IRA could be withdrawn and spent as needed on health-related costs and/or custodial care. Any IRA funds that are preserved can be passed down to heirs.

Pension's prospects. A pension plan's "funded status" is a measure of its assets and liabilities that must be reported annually; a plan funded at 80% or less may be struggling. Most pensions are backstopped by the Pension Benefit Guaranty Corporation (PBGC), but retirees could lose a portion of the "promised" benefits if their plan fails.